Tax Mapping Setup

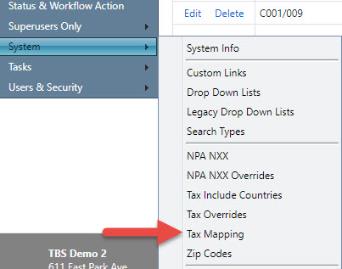

| How do I get here? | Setup ► System ► Tax Mapping |

| Purpose |

Tax Mapping functionality now available in TBS provides a new level of control over tax codes. Through the new Tax Mapping setup page, unused tax codes can be removed from TBS. This allows for the removal of tax codes that are not applicable, simplifying the tax selection process. Admin users can also add New tax records and create taxing splits, where two or more tax codes are applied to the same tax record with a percentage applied. This allows one tax record to split up how a charge in TBS will tax between multiple codes. Finally, the fields used to select taxes have been consolidated into one Tax Mapping field with a dynamic search. |

| Security |

Maintenance Module |

| Taxing Impact | N/A |

| Commission Impact | N/A |

| Data Field Definitions | N/A |

Tax Mapping Setup

LOCATION: Setup / System / Tax Mapping

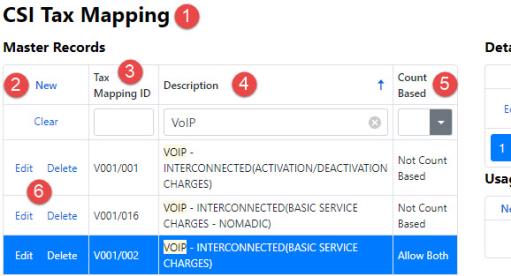

Master Record

-

Title in the top left corner indicates the tax engine used by TBS

-

New in Master Records grid will add a new Master Tax record

-

Tax Mapping ID is the user defined ID for the tax record

-

Description is the user defined description for the tax record

-

Count Based indicates if a tax is based on number of telephone lines

-

This should never be modified for existing records

-

This should always be set to Not Count Based for new records

-

-

Edit and Delete allow admin users to modify or remove a Master Tax record

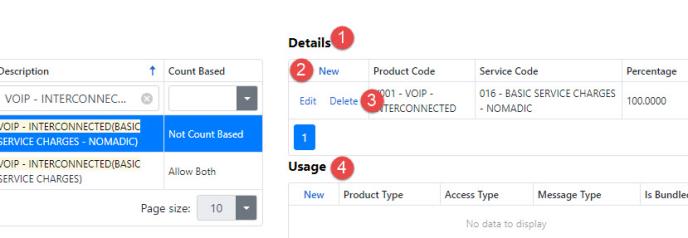

Details Record

-

Details link tax engine codes to the Master Record highlighted

-

New in Details grid will add a new detail with dropdowns for the tax engine codes and a percentage field

-

Edit and Delete allow admin users to modify or remove Detail records

-

Usage is for usage type taxes only and should not be modified, reach out to precision support with any questions or concerns regarding usage taxing

Adding / Editing Master record

Clicking the New button under Master Records or the Edit button for any existing Master Record will allow admin users to set the Tax Mapping ID, Description, and Count Based dropdown.

-

User defined Tax Mapping ID

-

User defined description of Master Record

-

Count Based - should always be set to Not Count Based for new records

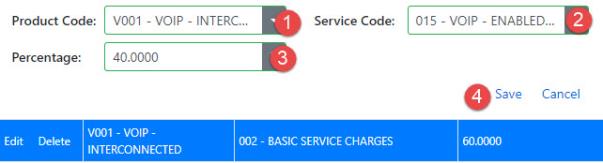

Adding / Editing Details

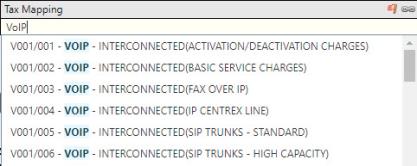

Clicking the New button under Details or the Edit button for any existing Details will allow admin users to map taxing details to the highlighted Master record. The tax codes listed in the dropdowns will depend on the

-

Tax engine Product Code dropdown

-

Tax engine Service Code dropdown

-

Percent (only applicable if splitting taxes)

-

Save to commit changes or new entries

Tax Fields in TBS

When selecting a tax to apply across TBS, tax code fields have been replaced with a Tax Mapping dropdown that include dynamic search functionality

Pages that include updated Tax Mapping are:

-

Charges & Plans Inventory page in Setup (for charges only)

-

Miscellaneous Charges page in Setup

-

Transaction Posting page for debits and credits that include taxes

-

QuickBooks Importer for QuickBooks Items