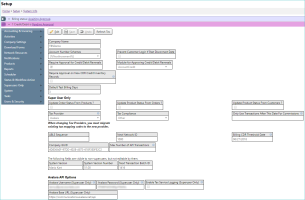

System Settings

| How do I get here? | Setup / System / System Info |

| Purpose |

This admin screen allows clients to change some default application settings as well as major system setting including those that impact Taxing Compliance and underlying Tax Engine. Please be cautious when making updates to these values as they are system wide and could have impacts on critical functionality. This page will also show the current system version and version number. |

| Security | Maintenance module |

| Taxing Impact | N/A |

| Commission Impact | N/A |

| Data Field Definitions | View Here |

Data Field Definitions

| Field | Definition | Notes |

|---|---|---|

| Company Name | Client Name | |

| Account Number Schemes | Master Account Number Scheme setting. If schemes are not set at the Group level, new accounts will use this scheme. | |

| Prevent Customer Login if Past Disconnect Date | If checked, will prevent customers from logging into the Customer portal is the Customer Disconnect Date is in the past. | |

| Require Approval for Credit/Debit Reversals | Specifies whether credit or debit reversals require permissions to be submitted. If the required permissions are not met and a user attempts to submit a credit or debit reversal, a pending credit or debit is added to the Approving Pending Credit/Debit screen, which can then be approved by someone with the necessary permissions. | By default, this field is selected (checked). |

| Module for Approving Credit/Debit Reversals |

Specifies which permissions module is used with the credit or debit reversal feature. In order to submit or approve credit or debit transactions, a user must have Add permission on the module specified in this field. |

By default, this field is set to the Accounting module. This field only appears after the Require Approval for Credit/Debit Reversals check box has been selected (checked). |

| Module for Approving Charges & Plans | Security module required for a user to have in order to approve Charges & Plans marked as Pending Approval | |

| Require Approval on New CDR Credit Inventory Records | TBS supports a CDR credit process from the Invoice Viewer. If checked, when requesting a CDR credit, the credit will be set to a Pending Approval status and require approval prior to applying to the account balance. Used in conjunction with the Module for Approving Charges & Plans. | |

| Default Test Billing Days | When used, the Begin Test Billing On date on individual billing definition records will default to the specified Run Dateminus the number of days specified using this option. | |

| Update Order Status from Products? | When all products tied to an Order reach a "Closed" status the Order status will be set to Complete. | Super User Only |

| Update Product Status from Orders? | Super User Only | |

| Update Product Status from Customers? | Super User Only | |

| Tax Provider | Indicates the Tax engine used in TBS. Options include Avalara and CSI | Super User Only |

| Tax Compliance | Indicates who provides tax compliance reporting on behalf of the Client. Options include Avalara, CSI or Internal. | Super User Only |

| ABLS Sequence | ||

| Next NetworkID | ||

| Company GUID | Unique identifier for the TBS system. | |

| System Version | Release name version | |

| System Version Number | Version number within the Release name | |

| Next Transaction Batch ID | Shows the next incremental BatchID to be used. Used on the Transaction Report. | |

| SMTP Server | Email SMTP server address | |

| SMTP Server Port | Email SMTP Server port | |

| SMTP Server Supports SSL | Indicates if the SMTP server supports SSL | |

| Messages per Minute | Some Email providers (ex. Office365) only allow a max number of emails per minute to be sent, otherwise they fail. This will throttle any bulk emails. | |

| Default "From" Address | Fallback default Email address for sending out emails if there is not one set on the Base record. | |

| Redirect Address | If a client has their own domain setup, but hosted by PTT this can be used to ensure the TBS URL redirects appropriately. | |

| Request Delivery Notifications from Server | ||

| SMTP Username | Email Username | |

| SMTP Password | Email Password | |

| Send Messages Synchronously | ||

| Email Integration: Note Address | If Enhanced Emails are turned on, this is the Address used for capturing email responses from users to ensure they are delivered through the PostMark email server correctly. | |

| Email Integration: Failure BCC Address | If Enhanced Emails are turned on, any that fail to get captured in TBS will be sent back to this address with a failure notice. | |

| Forrest UserID | TBS supports a file import process called FoREST that allows clients to load customer, product and charges data to an ftp to be sucked into TBS. A specific user must be setup in order to have this process trigger. | |

| Forrest Password | Password that goes with the Forrest UserID | |

| Avalara Username | Username for the Avalara Tax Engine | For Avalara tax engine clients only |

| Avalara Password | Password for the Avalara Tax Engine | For Avalara tax engine clients only |

| Enable Tax Service Logging | Saves the request and response files sent to the tax engine for testing purposes. | Super User Only |

| Business Class | CLEC or ILEC. If not set, CLEC will be used | For Avalara tax engine clients only |

| Service Class | PrimaryLongDistance or PrimaryLocal. If not set, PrimaryLongDistance will be used | For Avalara tax engine clients only |

| Franchise | True if client has franchise agreement; False if franchise taxes do not apply to seller. | For Avalara tax engine clients only |

| Regulated | True if seller is regulated; false otherwise. | For Avalara tax engine clients only |

| Facilities-Based | True if seller is facilities based; false otherwise | For Avalara tax engine clients only |