Invoicing Data Field Definitions

| Field | Description | Notes |

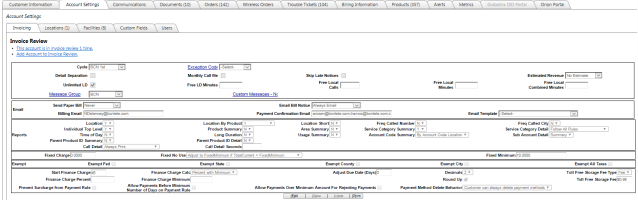

| Cycle |

Billing cycle designation. Cycles are assigned certain days of the month that they bill - therefore this determines when the customer will invoice during the month. Typical bill cycles are alpha numeric - Example: PTT01 would be a cycle set for the 1st of the month. PTT15 would be a bill cycle set for the 15th of the month. Customers should NOT change billing cycles once the first invoice has generated as these also drive invoice dates and charge dates for the month. Multiple cycles can bill on the same day of the month. However all cycles will have the same invoice date, start/end charge dates and be combined in billing reports. |

IMPORTANT: Payment Processor information is tied to the Cycle. In order to accept credit card or ACH payments, the cycle must be setup with the proper payment processor credentials. |

| Exception Code | Account Level rate plan exception codes (rate overrides) that apply to all lines on the account. | |

| Detail Separation | On the Invoice, after page 2, each report will be separated by a page break. | |

| Monthly Call File | If checked, a compressed file will be generated each month containing all call records for the account and placed into a folder on the billing server for access. Files can be accessed by the customer via FTP or the Wholesale portal (if Billing Type="Wholesale") | |

| Skip Letters |

If checked, this will IGNORE days late calculations on the invoice and not generate any late notices. If not checked, Late Messages will automatically be printed on the invoice according to days late. Late notices can be setup using the Invoice Messages admin tool. |

|

| Single Column Invoice |

This defaults to "N", meaning that the invoice will be produced as normal with all Page 3+ reports being presented in Two columns. Setting this flag to "Y" will cause the invoice reports starting on Page 3 to be presented in a One column format. |

This flag only impacts invoice reports starting on Page 3 of the PTT Invoice. Pages 1 & 2 will not be affected by this invoice flag. |

| Account Level Free Minutes (Traditional Products ONLY) | ||

| Unlimited LD |

If checked, will apply unlimited Domestic long distance rating to all long distance (LD, 8xx, Calling Card, Travel Card) products that have any of the Allow Free minutes check boxes set to True. Please see the Long Distance Data Definitions for more information regarding these fields. Does not apply to Alaska and Hawaii rates |

Applies to Traditional Products only. |

| Free LD Minutes |

Text box which allow up to 1000000 minutes to be entered as free Domestic long distance minutes on all long distance (LD, 8xx, Calling Card, Travel Card) products that have any of the Allow Free minutes check boxes set to True. Please see the Long Distance Data Definitions for more information regarding these fields. Does not apply to Alaska and Hawaii rates |

|

| Free Local Calls |

Text box which allows up to 10000 calls to be entered as free standard local calls on all local products on the account. Does not apply to Extended Area of Service (EAS) or Extended Local Calling (ELC). |

|

| Free Local Minutes |

Text box which allows up to 10000 minutes to be entered as free standard local minutes on all local products on the account. Does not apply to Extended Area of Service (EAS) or Extended Local Calling (ELC). |

|

| Free Local Combined Minutes |

Text box which allows up to 10000 calls to be entered as free standard and ELC and EAS local calls on all local products on the account. |

|

| Invoice Messages | ||

| Message Group |

This is the Invoice Message group that will appear on the Invoice. Invoices messages cane be setup / maintained using the Invoice Messages admin tool. |

|

| Custom Messages | Customers can have a custom invoice message printed on their invoice only. |

|

| Invoice Delivery Options | ||

| Email Template | The Email Template drop down allows a user to optionally override the default Email Billing Template (determined by Customer Group/Base) to be used for the account. If not filled, the system falls back to using the template defined on the Base record. | |

| Send Paper Bill |

Paper Bill Options for generating a paper bill file to be sent to the printer. Options include:

|

Note: Minimum Billing amounts are set at the Client level and apply to all clients. Please check with your account manager for settings |

| Email Bill Notice |

Email billing options for emailing billing notices. Options include:

|

Notes: 1 - Minimum Billing amounts are set at the Client level and apply to all clients. Please check with your account manager for settings 2 - Emails include a direct download link to a PDF version of the Invoice. PDFs cannot be attached. |

| Attach Invoice to Email Bill | Custom application setting that, if turned on, will also physically attach a PDF version of the invoice to the email. | This is not a standard feature. Please work with your account manager for settings and more details on this feature. |

| Billing Email |

Email address used for sending ebill notifications. Multiple addresses can be supported by using a comma or semi-colon. |

|

| Payment Confirmation Email |

Email address used for sending payment confirmation notifications. Multiple addresses can be supported by using a comma or semi-colon. Payment Confirmations are sent AFTER the payment is posted to the account. |

Note: Payment confirmations are typically ONLY sent for non-recurring credit card/ach or manual check payments. Notifications are not sent for customers setup for recurring. |

| Invoice Report Options | ||

| Location | Please See Invoice Reports | |

| Individual Top Level | ||

| Product Summary | ||

| Area Summary | ||

| Frequently Called Number | ||

| Frequently Called City | ||

| Time of Day | ||

| Long Duration | ||

| Usage Summary | ||

| Account Code Summary | ||

| Invoice Category Summary | ||

| Call Detail | ||

| Call Detail Seconds | ||

| Currency | Currency for the customer. This is just informational. TBS does not have currency conversion support on the invoice or when accepting payments. Default is US dollars. | |

| Decimals |

Otherwise known as "Precision". The number of decimals to use when rating call records. TBS support up to 4 decimal places for precision. |

|

| Round Up | If checked, the billing system will round up all charges and rating. | |

| Tax Exemptions | ||

| Exempt Fed | Exempts all Fed Taxes except Federal USF |

Impacts Taxing. Please be sure to review the Taxing in TBS help topic. If a specific Federal, State, County or City tax is needed to be overridden (but not all), PTT can support this. Pleas note that this means the tax is set to zero rate, so neither the client nor the customer is responsible. Please use caution and external tax compliance advise when requesting these types of tax overrides. Please work with PTT to set up this special tax exemption. |

| Exempt State | Exempts all State Taxes | |

| Exempt County | Exempts all County Taxes | |

| Exempt City | Exempts all City Taxes | |

| Exempt All Taxes | Exempts ALL taxes mentioned above including Federal USF. | |

| Fees (Toll Free Storage, Finance Charges, Minimum Billing Adjustments) | ||

| Fixed Charge | Fixed Charge to apply based on Fixed No Use setting | Used together to generate Minimum Billing business rules |

| Fixed No Use |

Options for applying a Minimum Billing Fee. Used in conjunction with the Fixed Charge field / Fixed Minimum Field. Options include.

|

|

| Fixed Minimum | Minimum amount to be considered when applying Fixed No Use minimum billing rules | |

| Start Finance Charge |

Number of days past the invoice date (days late) to start applying a finance charge if balance >0. Note: Overriding Finance Charges: To stop a finance charge or to override the default amount of finance charges applied, use the following fields. Example: To not apply a finance charge to a particular customer, set the Finance Charge Percent to 0 and Finance Charge Calc to Percent Only. |

|

| Finance Charge Calculation |

Method for calculating the finance charge amount. Options include:

Used in conjunction with the Finance Charge Calculation value. |

|

| Finance Charge Percent |

Overrides the company finance charge percent. Default and maximum finance charge percent is set to 1.5% |

|

| Finance Charge Minimum |

Dollar amount of the minimum finance charge dollar amount that should be applied, Used in conjunction with the Finance Charge Calculation value. |

|

| Adjust Due Date (Days) |

Overrides any bill run invoice due date defaults. Number of days to adjust the customer's due date (calculated from the Invoice Date). Also impacts when to start calculating Days Late. For example: Consider an account with a Charge Transaction dated 7/1/2013. On 8/1/2013 with an "Adjust Due Date (Days)" value of 0 (default), this customer would show Days Late=31 and Days Aged=31.

In TBS, the Customer header displays the current balance and "Days Late/Aged" (previously just "Days Late"). Likewise, on the Billing Information tab, if there is a value in "Adjust Due Date (Days)", then the Days Late value will reflect the proper days late and the label will appear as "Days Late (net X)" where X will display the "Adjust Due Date (Days)" value. There is also a field for "Days Aged". |

Setting the "Adjust Due Date (Days)" value will affect the aging of all transactions on the account. Please be aware as any changes could significantly redistribute account balances into different aging buckets. |

| Toll Free Storage Fee |

Dollar amount of the 800 Toll Free Storage Fee to be applied to all 8xx lines (not disconnected, blocked or in New status) based on the Toll Free Storage Type Company default can be set so that all customers are defaulted with the same amount initially, but can be overridden on a per customer basis if desired. |

Applies to Traditional Products only. |

| Toll Free Storage Type |

Two options exist for applying the above Toll Free Storage Fee. Options include:

|

|

| Prevent Surcharge from Payment Rule | See Payment Rules. Flags customer as exempt from any single or auto payment credit card/ACH processing fees. | Note: If no payment rule exists specifying a surcharge, the checkbox labeled "Prevent Surcharge from Payment Rule" will be hidden |

| Allow Payments Before Minimum Number of Days on Payment Rule | See Payment Rules. Allows a customer to make additional payments despite any restrictions setup within the CC/ACH payment rules. | Note: If no payment rule exists specifying a minimum number of days between payments, the checkbox labeled "Allow Payments Before Minimum Number of Days on Payment Rule" will be hidden. |

| Allow Payments Over Minimum Amount for Rejecting Payments | See Payment Rules. Allows a customer to override the minimum amount for rejecting payments and allows any amount of payment to be processed. | Note: If no payment rule exists specifying a minimum amount for rejecting payments, the checkbox labeled "Allow Payments Over Minimum Amount For Rejecting Payments" will be hidden. |

| Payment Method Delete Behavior | Flag to indicate if customer can delete payment methods (Credit Cards or Bank Accounts) via the customer portal. Customizable via Drop Down menus. Options with a negative underlying value equate to not being able to delete. Options with a positive underlying value equate with the ability to delete payment methods. | The options can be maintained by choosing Drop Down Menus from System Administration.

|